From a mortgage perspective, little increases in basis points can suggest larger adjustments in the interest rate you might pay. The lender as well as the marketplace identify your price decrease, and it can change after the fixed-rate duration for your Get more info home loan ends. That's why it's important to ensure your break-even point happens well before the fixed-rate ends. For Bank of America consumers, however, if prices go up during the adjustable duration, your rate will certainly be reduced based upon the factors you initially bought. If you have a flexible rate home loan, your settlement might raise at change dates, because your rates of interest might enhance by some basis points. Need to your rates of interest boost by 25, 50 or 100 basis factors, it's simpler to simply specify the rise in regards to a quarter, half or 1 percent.

Khadija Khartit is a method, investment, and funding specialist, and also a teacher of fintech and also strategic finance in leading universities. She has actually been a financier, entrepreneur, and advisor for greater than 25 years. A lending estimate is a three-page form that presents mortgage information in an easy-to-read, well-explained layout, making it easy to compare deals. For more information regarding relationship-based ads, on-line behavioral marketing as well as our privacy methods, please evaluation theBank of America Online Personal privacy Noticeand ourOnline Privacy FAQs. Contact a tax specialist to see whether acquiring mortgage factors could influence your tax circumstance.

- Figures are commonly priced quote in basis factors in money, particularly in set revenue markets.

- A buydown is a home loan financing method where the customer attempts to obtain a lower interest rate for a minimum of the home loan's very first couple of years however perhaps for its life time.

- Being equipped with this details may offer you an edge in regards to getting the lowest rates of interest feasible.

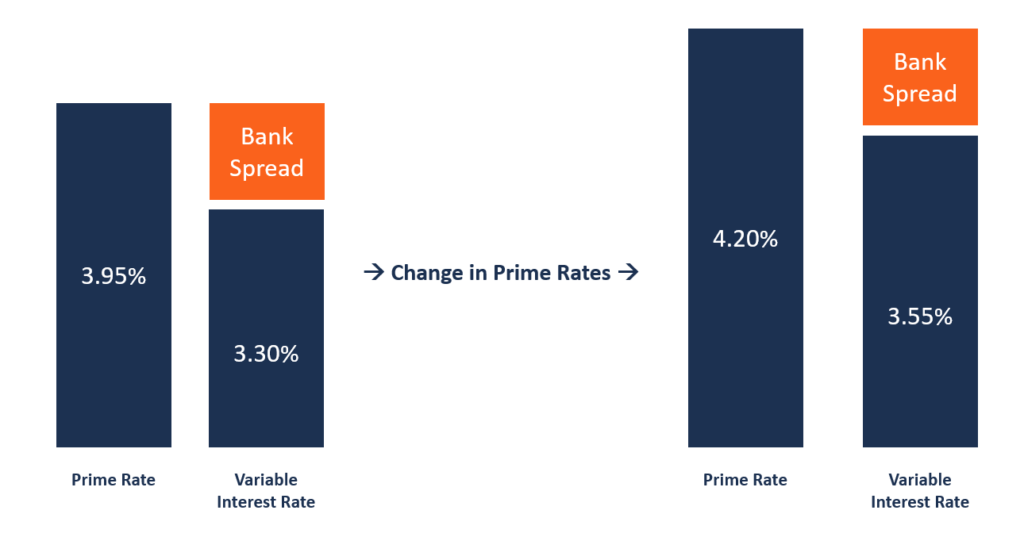

( e.g. 60-day price lock) Used regularly in an increasing price market. A mortgage loan which is authorized by First Hawaiian Bank under the bank's own terms and conditions. Generally the funding is not marketed to another organization, and also consequently FHB births the threats of payment and passion. The routine exam of escrow accounts to establish if present month-to-month down payments will certainly give sufficient funds to millennial couple pay insurance, property taxes as well as various other expenses when due. Modifications to the CIBC Prime Rate are occasionally described in terms of boosts or reduces in basis points.

What Is The Difference Between Basis Points As Well As Discount Rate Points?

In the above calculator the break even point determines how much time https://meleenyrxo.doodlekit.com/blog/entry/20650928/fixed-interest-rates-on-home-mortgages-traditionally-reduced it considers points to pay for themselves if a home purchaser decides to buy home mortgage price cut points. A house owner requires to reside in the house without re-financing for a prolonged amount of time for the indicate spend for themselves. If you are most likely to repay the residence soon before the bank reaches their break even then you might get the winning end of the offer. Purchasers that are charged adverse factors should guarantee that any extra over & past the closing cost is used against the loan's principal. Our home mortgage calculators help you focus on the lending alternatives that are best for you. Up to two authentic discount points can be left out from from the Qualified Mortgage points and also charges cap.

Just How To Figure Mortgage Interest Rates & Settlements

Because APRs integrate line product prices, they are almost always revealed with three decimal locations to be as particular as feasible. Basis factors been available in handy when you're contrasting APRs from loan provider to lender. Nonetheless, if your APRs were 4.031 percent as well as 4.161 percent on the very same four-percent price quote, you 'd know the APR that's 13 basis factors higher will eventually have higher closing-cost line items. The rates of interest for an ARM regularly changes when a monetary index tied to your home loan additionally changes.

Just How We Make Money

Learn what it takes to establish a successful restricted insurance provider-- one that sets the typical as well as endures the examination of time. Gives detailed instructions that would certainly benefit novices as well as experienced professionals alike. Our 2nd re-enrolment overview looks at how to audit the crucial areas of your auto-enrolment plan. It was a different tale at 95% LTV-- right here the rate ticked up by 3 basis factors, to 3.21%, as well as at the various other end, at 60% LTV, the average price expanded by 6 basis factors, taking it to 1.86%.